Configure the different types of taxes applicable to the hosting and its products and services.

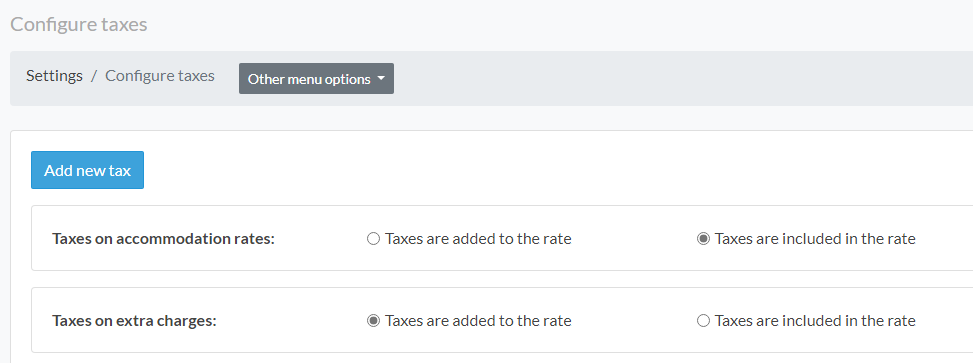

Start by configuring the taxes in Menu > Settings > Configure taxes.

- In the configuration interface, you will find two blocks with the options Taxes on hosting fees and taxes on extra charges. Select the desired option considering the following:

Taxes are added to the tariff:

Selecting this option means that taxes will be added to the rate you already have set for accommodation or extra charges in a reservation. Example: If the rate is $100,000 then if you apply a 19% tax the total to be paid will be $119,000.

Taxes are included in the rate:

Selecting this option means that taxes will be included in the pre-set rate. Example: If the rate is $100,000 then if you apply a 19% tax the total due will be $100,000, but a tax value of $15,966 and a base rate of $84,034 will be broken down on the invoice or statement.

NOTE: For the case of products and services configured at the point of sale, consider that these only work with taxes included in the rates.

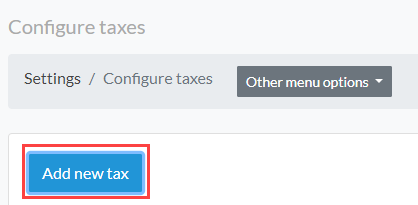

Now, let's create a tax:

- To create a tax, you must click on the Create Tax button.

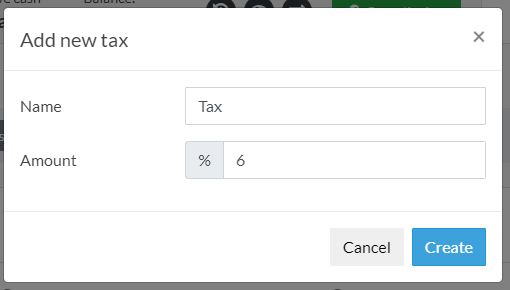

- Then you must assign the name of the tax and the percentage value.

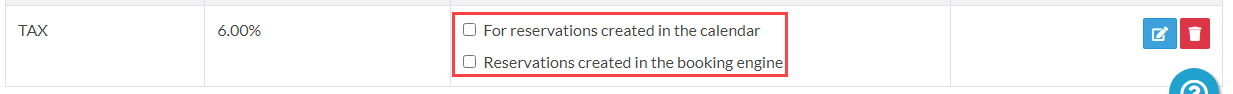

Once created, the listed tax provides two options that serve to automate the process of applying the tax.

Use the Auto Apply on Reservations options if you want the taxes to be applied automatically when the reservation is created.

NOTE: The option to assign tax automatically when creating reservations from the booking engine is only available if you have selected taxes included in the accommodation rates.

Comments

0 comments